I know Ive been posting a lot about cryptocurrency investments and how much you can make by investing in them, but there is another type of investment that is also very low risk and will help you to diversify your portfolio among your different investments. The type of investment I will discuss below is known as a REIT(Real Estate Investment Trust), and there are many perks and advantages to investing into them.

Founded in 2012 and headquartered in Washington, DC, Fundrise is one of the leading real estate investment platforms. Fundrise’s main mission is to empower the individual investor by giving them higher returns than they would get from the stock market eREIT’s alone(I will explain the difference further down in this article).

Real estate has historically been one of the best performing investment assets and a core part of many of the most successful investor’s portfolios. 1

But investing in real estate (the way institutions do) traditionally hasn’t been available to most investors without either meeting high net worth requirements or going through a complex and inefficient process, riddled with high fees and outdated middlemen. 2

We started Fundrise with a simple idea: to use technology to make high-quality real estate investments available to everyone at a low cost.

In the beginning, we faced our fair share of skeptics, especially within the institutional investment industry. They said our idea wasn’t possible. Turns out, they were wrong.

Since launching our first offering in 2012, we’ve invested in more than $4 billion worth of real estate across the country. Today, we manage more than $1 billion of equity on behalf of more than 130,000 individual investors.

-From the Fundrise Website

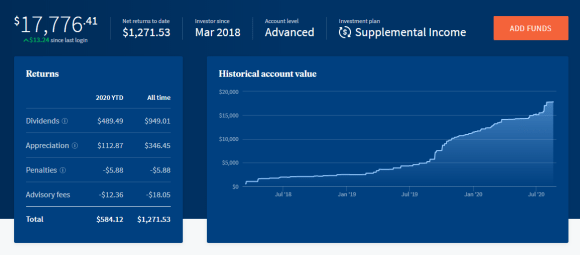

I have been invested with Fundrise since March 2018, and my account is getting close to $18,000. Im currently making almost $3 per day in dividends, and i always reinvest the dividends at the end of each quarter. Fudnrise pays dividends four times per year or quarterly.

Please see Fundrise portfolio snapshot below of my earnings to date. I had not logged in for a couple of days and you can see how I had a nice little increase of $13.24. You will also see my all time earnings is more than $1,200 now. If you just keep reinvesting the dividends the amount in your account will continue to snowball.

Average rate of returns over this time period in my investment have been phenomenal. See below performance chart:

There are also other REIT’s you can invest in through the stock market. These are known as publicly traded REIT’s. This below quote from the Fundrise website sums it up nicely how you pay more fees for the publicly traded REIT’s than you do with a private REIT like Fundrise.

Large publicly-traded REITs like these offer the benefit of owning stabilized real estate — properties with high to full occupancy rates — which provide owners with regular monthly rental income.

These large public REITs have gathered their assets over several years or even decades in both the private and public markets. As the investment moves through the value chain from origination to public investor, a long line of intermediaries, from Vanguard to private operators and developers, take cuts in the form of fees and expenses, for which investors ultimately foot the bill.

– From the Fundrise Website

So the best way to avoid these fees and get a higher rate of return on your investment is to invest with a private REIT like Fundrise. There is a small portfolio management fee of around 1.0% which is actually cheaper than what a publicly traded REIT would charge you to invest your money and manage the portfolio of investments. See chart below:

You can have your advisory fees waived for 180 days with each friend who joins Fundrise. Each friend will have their first 90 days of advisory fees waived, too. If you have not already signed up for this amazing opportunity then please sign up in the link below:

Taking all these things into account I have nothing but good things to say about Fundrise and the company as a whole is the best one you can invest in within the private REIT sector. The customer service is great and they respond very quickly to any questions investors might have about the company or their investment.

Fundrise has three options when it comes to investing in their REIT platform : Supplemental Income, Balanced Income, and Growth Income.

Supplemental Income will get your dividend payouts coming in quicker as its more invested in rental incomes and properties that are producing a profit right now. Long-Term Growth Income will get you invested in more equity based types of projects over longer periods of time, such as projects currently under construction, and renovation projects that will increase in value over time. The dividends are lower with the Long Term Growth option but the equity build up over time through apprecition of shares you buy in the company is greater. If you dont like either one of those options then you can opt to go with the Balanced Investing option which gives you the best of both worlds.

No matter which option you choose to go with Fundrise is a great company that has been around since 2012, and knows the real estate market very well. I feel they are a company I can put my money and trust in. If this opportunity is of interest to you, and you would like to get started in Fundrise then please signup under my referral link below.

Thank for reading and goodbye until next time!

-Evan M.